How to Crack CA Exam

Posted by: Admin | 30 Apr 2020

In education, an examination just tests to show the knowledge and ability of a student, and it is not the scorecard of a person's personality. But it is necessary to take examinations for a cross-check whether our learning is going in the right direction or not. So, in this article, I will be putting light on the examination which is held nation-wide, CA (Chartered Accountant) exams Around 26k candidates appear each year for various CA exams.

The CA (Chartered Accountant) is one of the respectful and challenging career fields. A chartered accountant works as a private advisor or in the accounts department in an organization. He plays an important role in case of disputes, bankruptcy, etc. It is held in various stages like:

- CPT (Common Proficiency Test)

- IPCC (Integrated Professional Competence Course)

- FC (Final Course)

The top recruiters of the chartered accountant are as the following:

- Banks

- Auditing Firms

- Finance Companies

- Mutual Funds

Now let us understand what these terms are.

- The CPT - This is the entry-level foundation course involves the quantitative aptitude test, general economics, mercantile laws and accounting.

- The IPCC - This has two groups. It covers the working knowledge of the core subjects. It is specially designed to improve the knowledge of accounting standards.

- The CA final - This course covers the advanced knowledge of financial reporting, management accounting, strategic financial management, professional ethics, information systems control and advanced auditing.

There are 3 papers:

- CPT (Common Proficiency Test)

- Principles and practice of accounting

- Business laws and business correspondence and reporting

- Business mathematics, logical reasoning and statistics

- Business economics and business and commercial knowledge

- IPCC (Integrated Professional Competence Course)

- Accounting

- Business laws, ethics and communication

- Cost accounting and financial management

- Taxation

- FC (Final Course)

- Financial reporting

- Strategic financial management

- Advanced auditing and professional ethics

- Corporate and economic laws

- Strategic cost management and performance evaluation

- Direct tax laws and international taxation

- Indirect tax laws

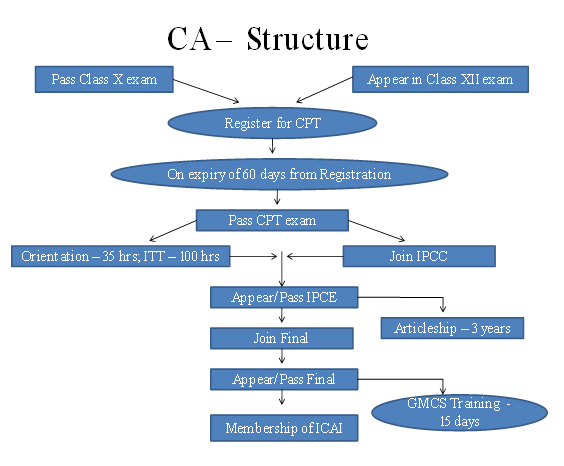

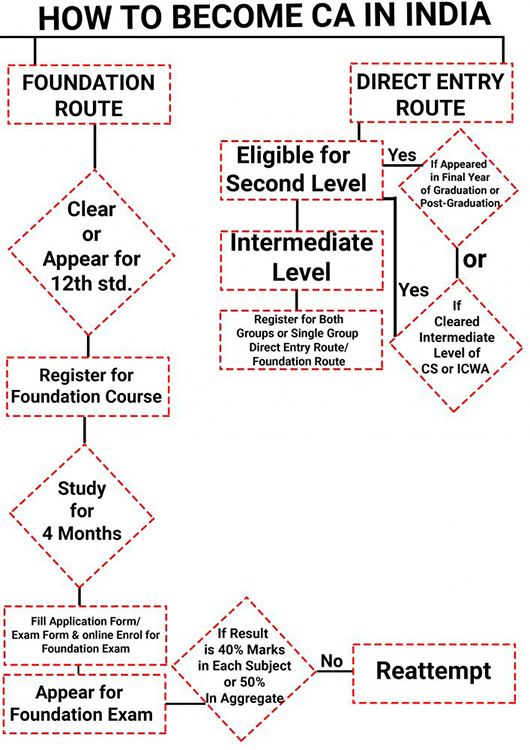

Eligibility

- Any student who has passed 10thclass or any course equivalent to that can apply for the Common Proficiency Course (CPC) first.

- Post qualifying for the 10+2 exam, a student has to then qualify in CPT exam.

- After the CPT IPCC, successful article-ship or training under an officially practicing C.A has to be done for 3 years.

Skills Required

- Numerical Ability

- Logical & Methodical Approach

- Good understanding of the socio-economic environment in which organizations operate

- Necessary skills in applying theoretical knowledge to practical situations

- Good Verbal & written expression

- Ability to deal with different types of people

Syllabus

Subjects for Foundation course

- Paper 1: Principles and Practice of Accounting

- Paper 2: Business Laws & Business Correspondence and Reporting

- Paper 3: Business Mathematics and Logical Reasoning & Statistics

- Paper 4: Business Economics & Business and Commercial Knowledge

Subjects for Intermediate Course:

- Group I

- Paper 1: Accounting

- Paper 2: Corporate and other Laws

- Paper 3: Cost and Management Accounting

- Paper 4: Taxation (Section A: Income Tax Law and Section B: Indirect Taxes)

- Group II

- Paper 5: Advanced Accounting

- Paper 6: Auditing and Assurance

- Paper 7: Enterprise Information Systems & Strategic Management

- Paper 8: Financial Management and Economics for Finance

- Group I

- Paper 1: Financial Reporting

- Paper 2: Strategic Financial Management

- Paper 3: Advanced Auditing and Professional Ethics

- Paper 4: Corporate and Economic Laws

- Group II

- Paper 5: Strategic Cost Management and Performance Evaluation

- Paper 6: Elective Paper (any one of Risk Management, Financial Services and Capital Markets, International Taxation, Economic Laws, Global Financial Reporting Standards, Multi-disciplinary Case Study)

- Paper 7: Direct Tax Laws & International Taxation

- Paper 8: Indirect Tax Laws (Part 1: Goods and Services Tax and Part 2: Customs and FTP)

After knowing the syllabus, the vital thing that comes to mind is how to strategize our studies.

- Have proper planning for the whole day and divide the time into different sections where you can devote time to all the sections equally.

- There should be an adequate timetable which should be followed religiously.

- You should know your weak and strong points do that you can devote time accordingly.

- Make the best use of all the available online resources.

- Be updated with all the general knowledge. Do maintain notes if the events that are happening worldwide. And keep an eye on the economy too. This not only increases our awareness but also helps us in enhancing our verbal skills too.

- Download previous years question papers because nothing can be much more beneficial than them.

- Do make short notes of the content which you have read to have a perfect last-minute revision.

- To enrol in a test series that will help in keeping pace with time.

So, keep practising, and then nothing can stop you!!